What We Do / Equity & Macro Research

Equity & Macro Research

Overview

Our Equity & Macro Research division combines traditional fundamental analysis with modern data analytics to generate actionable investment insights across global markets.

We train members in financial modeling, valuation techniques, and macroeconomic analysis—skills essential for careers in equity research, portfolio management, and investment banking.

Generating Investment Insights

From macroeconomic outlooks to company-specific deep dives, our research team produces institutional-grade analysis across asset classes and geographies.

Research Objectives

Three pillars of our analytical framework

Market Outlook

Comprehensive analysis of global macroeconomic trends, central bank policies, and their implications for asset allocation across equity, fixed income, and commodity markets.

Industry Deep Dives

Sector-specific research covering competitive dynamics, regulatory landscape, technological disruption, and long-term structural trends shaping industry profitability.

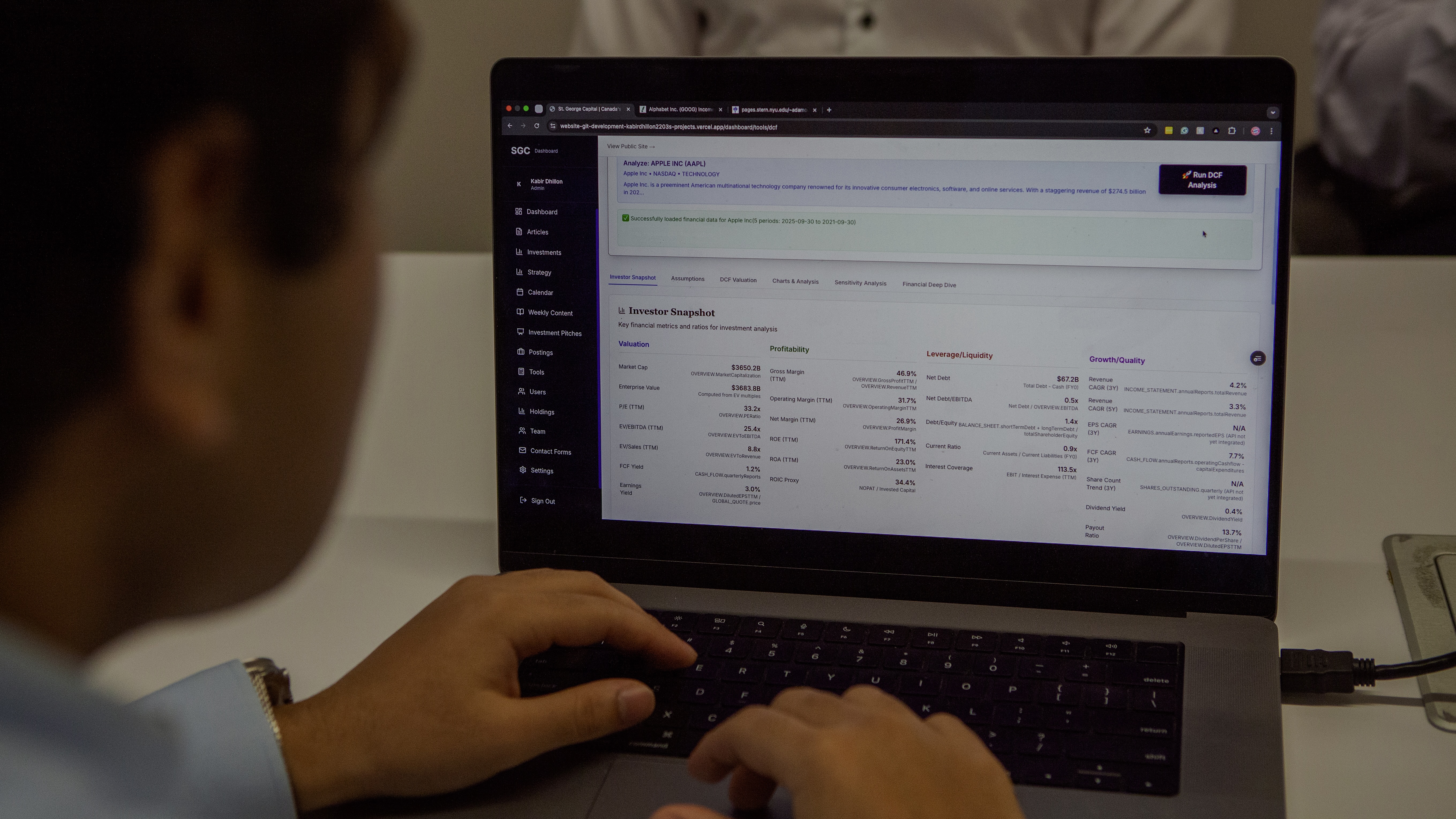

Company Health Evaluations

Fundamental analysis of individual securities including financial modeling, valuation, competitive positioning, and management quality assessment.

Investment Principles

Our disciplined approach to equity investing

Bottom-Up Analysis

Focus on individual company fundamentals, competitive advantages, and growth potential.

Top-Down Framework

Understand macro trends and sector dynamics that drive investment themes.

Risk-Aware Positioning

Evaluate downside risks and stress scenarios for every investment thesis.

Long-Term Perspective

Identify sustainable competitive advantages and secular growth opportunities.

Research Process

1. Idea Generation

Screen for opportunities using quantitative metrics and qualitative insights.

2. Due Diligence

Build financial models, analyze industry dynamics, assess management quality.

3. Thesis Development

Articulate investment rationale, target price, risks, and catalysts.

4. Monitoring & Updates

Track performance, update models, reassess thesis as new information emerges.

Typical Coverage Areas

Ready to Dive Deep?

Join our equity research team and develop the analytical skills that top investors value.

Get Started